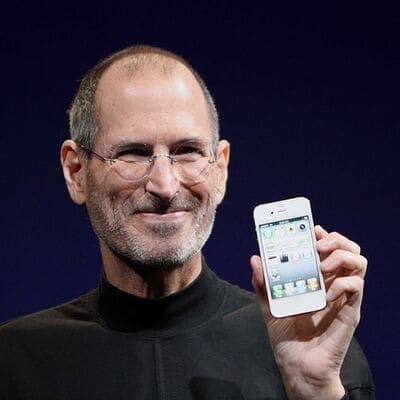

For all the rockstars at work

If you are an over performer and doing great work at your company, I request you to also start working for yourself. You have no idea how much you can make just working directly for clients.

1. What do you do exactly? 2. Since how long have you been consulting? 3. How did you get your first client? ...

this is what makes grapevine great. thanks for the Saturday motivation. back to work fellas.

In marketing services what exactly do you do for clients? What's your skillset? Asking to understand what exactly you...