URGENT...ex employer sent me legal notice for using medical insurance

Hi everyone,

I’m in a really difficult situation and need some suggestions from anyone who has dealt with something similar. (TLDR at the end)

I am so scared that my hands have been shivering & have been pacing back & forth since I got Legal notice from my employer.

My circumstances-

I am a Only child (34F & unmarried) looking after my widowed mom (56F) who was mentally & physically ill. She had chronic bipolar & kidney failure (on dialysis). Unfortunately my mom got admitted to a hospital in April & passed away in May after prolonged hospitalization.

I worked with a company from 2023 to 2025 (Mar). During my employment, I had insurance coverage under the company's group insurance policy for 6lacs, which included coverage for my mother. My employment ended on March 31, 2025, I couldn't continue as they wanted me to come to bangalore office 8days a month which was not possible as I was sole caregiver to My Mom & grandma & we lived in Chennai where my Mom was on transplant list.

In April 2025, my mother was admitted to the hospital for treatment (due to burns), and I ended up submitting a claim under the insurance policy (cashless). The claim was processed for a 6 lakhs out of total claim of 24-25lacs across 3 hospitals (all continuous).

Somehow by hook & crook we managed to settle bills. Infact mom's body was withheld by Apollo until I settled bill 1 day later after she passed away. I had to go through excruciating process of my mom's Post Mortem & formalities with Police which is a story for another day. It was harrowing as I had no one to help me (relatives useless) & had to do it mostly alone.

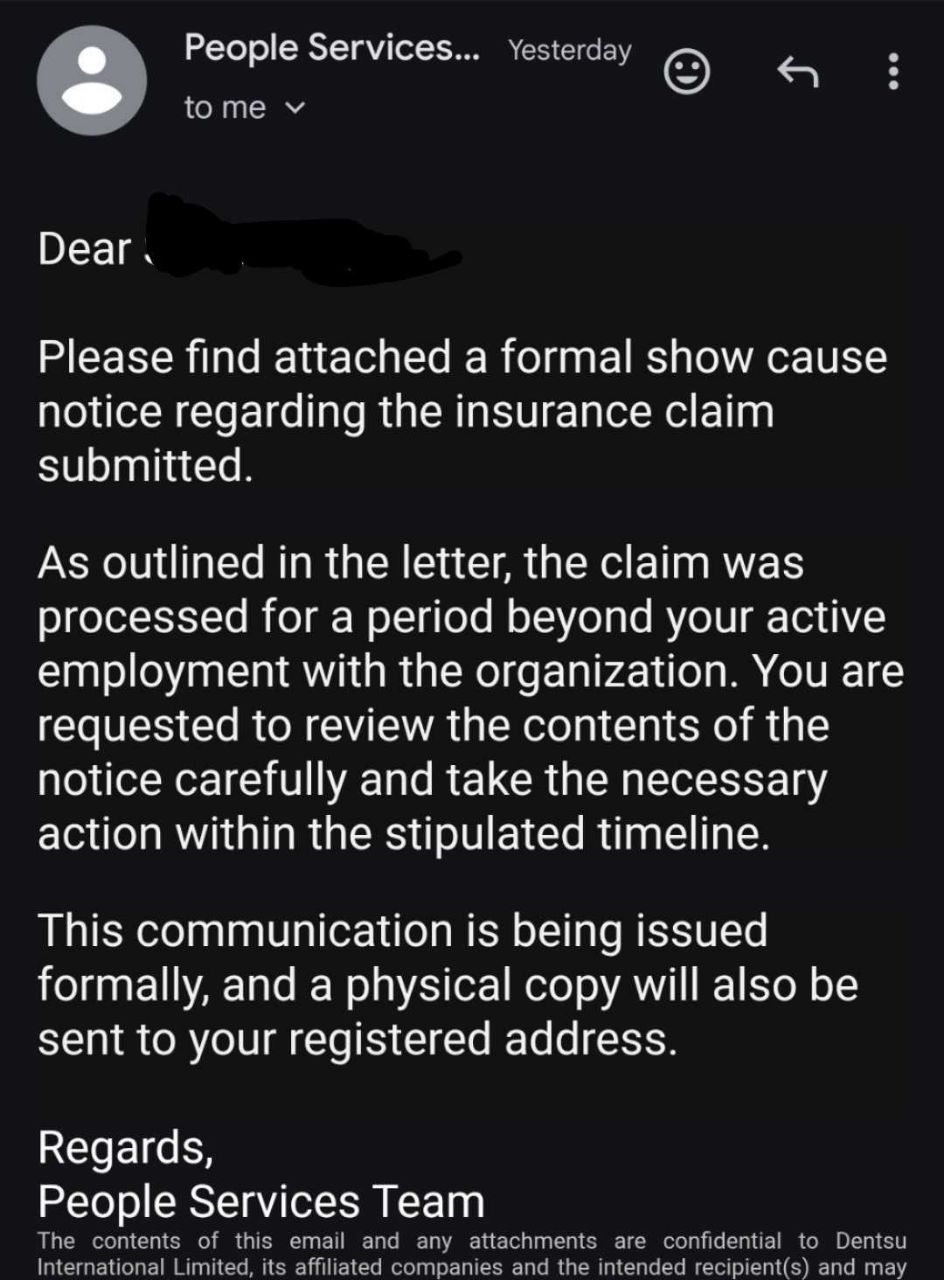

Yesterday , out of the blue my company has sent me a formal notice stating that the claim was made after my employment ended and is thus invalid. They are accusing me of fraud and demanding that I reimburse the entire claim amount within seven days, or face legal action.

Now I currently jobless , I had a 2nd round of interview scheduled on the day my mom was hospitalized in ICU (April) so couldn’t attend & had to give up that opportunity. I started looking for jobs only 2-3 weeks after my mom passed away in May. Have only 1 interview opportunity since then but not selected anywhere yet.

Now we don’t own a home , I have my 81yr old grandma to support & I am already drowning in debt as i have taken bank loan , money from apps & loans from 2 friends & a distant relative. I have not paid EMI in past two months & have already received messages that credit bureau have been intimated of my overdue status.

I m currently trying to figure out how to handle this situation and I need advice on the following:

- Has anyone here faced a similar situation with post-employment insurance claims?

- What should my immediate next steps be?

TLDR : Submitted a medical insurance claim for my mom in April 2025, not realizing my employment (and coverage) ended in March. Mom sadly passed away after a long hospitalization; I was her sole caregiver and had no support. Now ex-employer has sent a legal notice accusing me of fraud and asking me to repay ₹6 lakhs in 7 days. I'm jobless, in debt, and mentally broken - need urgent help/advice.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Settle the disputed amount, it was wrong on your part to utilise the insurance cover which wasn't there in the first place. May God give you strength to overcome the hardships!

Unfortunately, I am not in a capacity to get that money or repay it anytime soon. Out of 25lacs...only 6 lacs was paid by insurance and rest I had to scrap together through various means I mentioned in the post. Due to frequent hospitalizations in past 4 years , I had to expend all my savings & more. My networth is currently negative.

I was the only earning member all these years.

Bro let them send legal notice. Don’t do anything. Don’t pay now. Fight the case in court if they do so. Court will do justice. It’s the insurance company who has paid not the employer. They should not have any problem

Give them written reply that you were not aware and thought it would fall under grace period

And you want to return the sum but you are unable to do because of your conditions, mention the conditions and that all your means have been exhausted.

Keep stalling the time.

But I am not sure how it may impact your future employment opportunities.

I always thought the insurance provided can be used in the respective time period that got provided, irrespective of whether we are employed with the company or not as it's a third party.

You can explore routes of crowd funding. May be DM to few influences who work on this and tell them your situation with all the medical records and they can help. Not sure if GV has such thing but we as a community can help you too.

600 people can contribute 1000 each and you’re good.

I have a comment on this. Check your records whether you have paid full premium amount through company salary or by yourself when you were leaving the company. If you have paid full premium amount, please inform your company that you've paid premium and it's ok to claim insured amount.

Do let me know if you need more advice. May all universe be of support to you ✨

Thank you , I received my FNF 7 days after I claimed the insurance amount. As per my calculations, they deducted only pro rate premium , not full premium for the insurance.

I am even willing to pay premium for 1 more month or even full premium but the HR said it is not in their terms. They are being really rigid.

But you were not aware they will deduct full premium or just partial. And under such circumstances no one goes and validates t&c. Either they should have sent it in written format or if fnf was done before claiming the amount you woulf have known. They are also equally responsible. What if you had not claimed the amount and in fnf they deducted full premium? In such an emergency thing who will check with hr whether you will deduct complete premium or not. I think this makes a point. But I would suggest to take legal advice as well.

I understand your situation and sympathise with you, however, legally your in the wrong here. You can seek legal counsel as well but I am pretty sure they would say what I am about to tell you that is your in the wrong here. Issue is you claimed the amount after your period ended. This is grounds for fraud as it is common awareness corporate insurance ends the moment employment ends. You can say you were not aware and stall but it may lead you to be slapped with notice of negligence furthering your legal troubles and your future employment opportunities will be hindered. My advice take loan or loan out from family and pay it up asap. Else it is going to be a legal nightmare for you as if a case is filed you will live with the track record of insurance fraud whixh is the worse thing you can have in your name

The following is a last plan and has high risk as well if all else fails and they dont gibe you grace period or you arent able to secure loan.

Your option would be to go to Social media and explain your plight which may get traction and help you even start a go fund me page maybe to help you with this. Ofcourse the company's name is gonna get dragged through muddy waters but same time they may back down for some time.

Thank you for responding. For voluntary insurance like parental insurance, it is applicable for the whole year. I know this because it was the case in my 2 previous organizations.

Only in Dentsu , they are removing parental insurance benefits immediately after leaving. They are alao not taking the whole premium even if i am willing to pay & only pro rated.

That's actually pretty sad, i hope someone on this board provides you with an actual solution

Company take 3rd party insurance. So what is the annual payment of that 3rd party insurance. Suppose you joined the company in july and started paying the insurance but you left on march but the insurance is already paid for complete year in that case it doesn't matter.

If the settlement is done that means you had the insurance and thats why they paid the money. Why the fuss??

If your insurance was over and then they paid half the money, then also its partially their mistake, they should not settle if the insurance is over.

If this is you case then not sure what to be done.

Yes. Part of the mistake is theirs as well. They shouldn't have settled if insurance has ended.

That is how it was in my old organizations.

However, in this company , they apparently deduct premium prorata. So they deducted premium only for the months I worked. I realized after I saw my F&F.

Our claim was 3 weeks after I left the organization. My F&F was settled after that.

Damn 6 lakhs is a big amount, how did they approve it without even checking eligibility? Can you read through the policy document and check if it was valid by any chance? Some companies like Wipro extend the insurance until policy end date instead of employees last working day.

As other comments have suggested, consult with a lawyer once before replying to any mail.

You've been through a lot, may God give you strength. There will be better days ahead, you just need to get through this storm.

She probably was eligible, fucking HR is playing the villain probably. Fuck HR

It is indeed a large amount , but only a fraction of what I had actually spent overall which was almost 25lacs across 3 different hospitals.

I cannot even explain how horrible the past 2-3 months have been , spending days in hospital , trying to be hopeful during uncertainty & then circling around Police , dealing with hospital that refused to release my mom's body for Post Mortem till I settled the bill.

What is more tragic is that my mom died because Apollo was negligent, they did minor non emergency surgery when her platelets were 40k...barely 2hrs layer she bled to death.

Dealing with all this and trying to come out of trauma & comes this shocker from my ex employer.

The employer is Dentsu , based in Bangalore

I want to add one more detail here , they sent me this notice the same day I sent them an email asking for status on my pending 15k in Night shift allowance.

Recently my mother passed away and my mental strength has gone for a toss and I thought my problem was bigger to deal with until i read this.

Hope you find a way.

I am sorry for your loss.

Unfortunately yes , my life has been a constant pitfalls. What I have mentioned here is just a fraction. Past few years we have been running around hospitals for my mother's health issues , she has been hospitalized 23-25 times in last 6 years.

Finally she was getting better this year , we were optimistic as she reached top of the transplant list after almost 8 years of dialysis & Unfortunately God cruelly snatcher her away from me.

Imagine 2 weeks after your mom's funeral you get a call at 4am from the hospital....saying to come quickly to the hospital as they have kidney for transplant...!

God has his favorites & I am not one of them.