Insurance for Parents

Hey y’all. I’m looking to get health insurance for my parents. Any suggestions? What should I look out for? What should I look for?

Talking product sense with Ridhi

9 min AI interview5 questions

Imp things to note would be

- Coverage of PED

- Cashless Network from your parent's place of stay

- Limits on different kinds of procedures

- Premiums could shot up exponentially as your parents move from one age bracket to another. Try to lock-in as affordable plan in the start as possible

- Don't be afraid if there gonna be a medical test before policy issuance. A medical test would rule out any future claim rejection on the basis of non-disclosure.

Don't fall for

- Sponsored Annual Health Check; In some policies they would increase you to a next tier just by telling that there is Annual Health Check covered they which would reimburse. Get it done on your own and save the money on the premium.

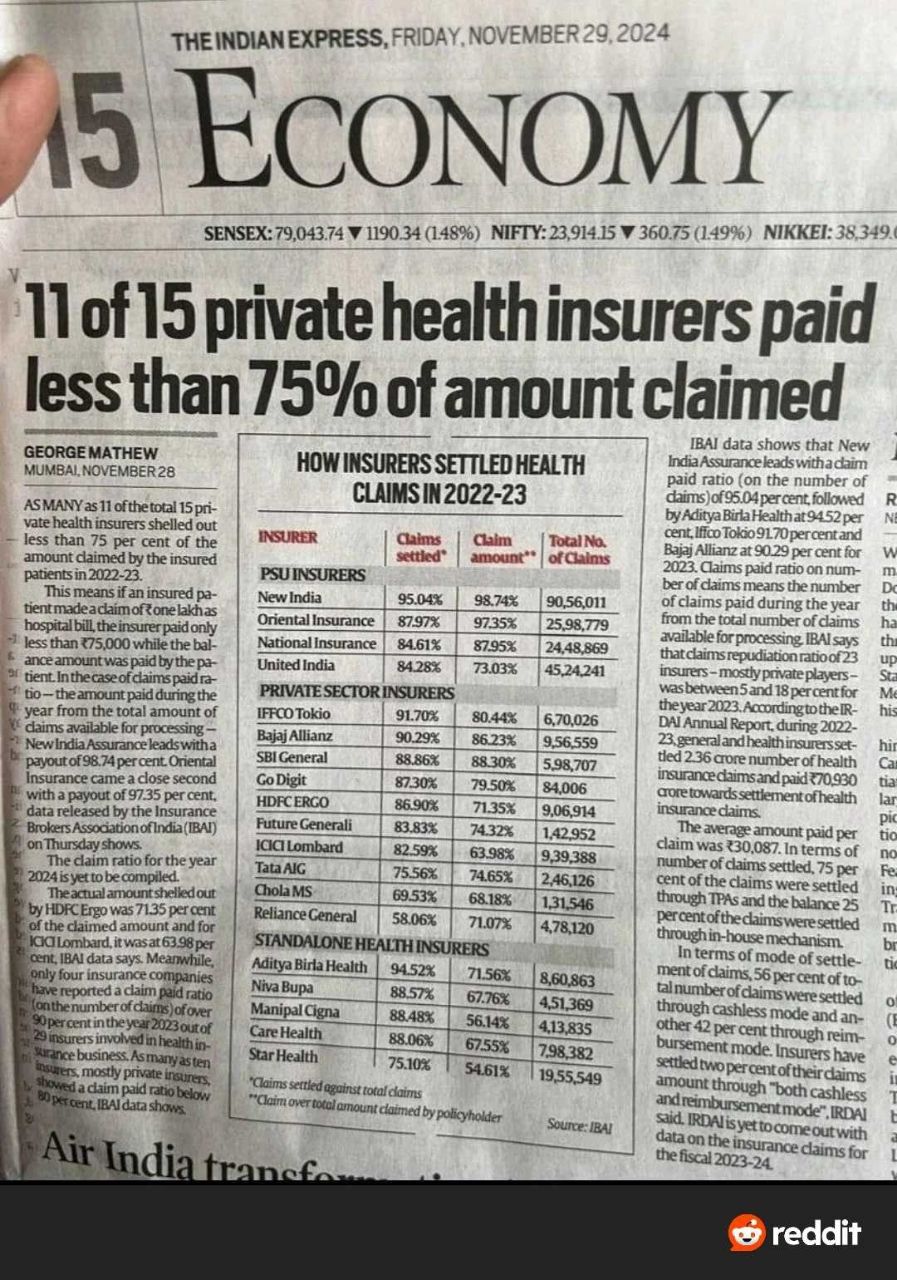

- Too cheap plans (Pointing at PSUs, St@r) as initially they would be very attractive but would not help at all in the claims.

ICICI Lombard Elevate could be a good plan.

But lock-in option is provided by a couple of companies in specific plans and that too with a clause that if a claim is made then premiums will start increasing according to age buckets just like other insurance. Do you know any specific plans which are good and we can lock-up the price. Because this is the major problem I am facing, premiums are getting too expensive already.

Hey...u mentioned St@r ...are u referring to star health insurance?

Insurance is moral support but the seed to good life span and health primarily rely on Food culture, physical activities for respective ages for Physical and mental well-being . If this is taken care of we don't need insurance. We have only 5L cover and we regret paying the premium however it's a moral support

Agree on the physicall wellbeing but disagree that we don't need insurance. Anything can happen.

@DamagedArray What are you smoking?

There are many many major health emergency hospitalizations that can happen.

Heart attack, brain stroke, All Road Accidents, Cancer, Transplants. Costs can go as high as 40-60lakhs too.

Recently 2 of my school juniors died after struggling in hospital for 10-15 days.....spent nearly 20 Lakh and 45 lakh respectively in an average quality hospital.

Couple of companies you should definitely not take from -

- Star

- Acko

- Niva Bupa

- Care

- Digit

- HDFC (only because of premiums, because you wont be able to continue it after 2 years).

Ideal scenario is always take 1 policy. But because premiums will be high, you can take super topup plans with a base of 5/3 lakhs and rest as topup. If you are taking this, make sure both the base and topup plans are from the same insurer and never from different companies.

If 2 parents, 25 lakhs is more than enough and sufficient. If I parent, 20 lakhs is very good. Anything more than this, is madness.

Never take riders like inflation beater, OPD, dental etc. Those are stupidity. If you must take a rider, go for critical illness cover only.

HDFC is the best, but impractical. Next are icici, Aditya birla, Manipal cigna, Bajaj Allianz etc and couple of more.

Always look for absolutely vanilla simple basic policy and never chase ornamentation of 4x, 5x cover, this and that flashy things. 90% of those are not relevant and will never be used but you'll always end up paying very high premiums. It's same as living in complexes. You never use 99% of the amenities but only for status symbol and boast to known circles, you end up paying unreal monthly maintenance.

Do full fledge company analysis of the insurer like you'd do if you were to angel invest in that company, before buying. Because ultimately you are investing that money in them only.

One way to manage the high premiums for HDFC for parents, is to take a fixed deductible (25k, 50k) as possible...

Helps in reducing the premium significantly

Check this

Few points I would recommend apart from what fellow people have suggested.

If you can afford a higher premium, go for HDFC Ergo. Otherwise, choose Care Supreme.

Avoid top-ups or super top-ups, as they often come with many caveats.

Keep things simple — maintain a high base plan instead of relying on add-ons.

Disclose everything; don’t hide any information.

Consider using Ditto — they assist during the claim process.

Always evaluate your requirements before selecting a plan.

Think long-term, not just for the present, because insurers often try to discontinue policies for elderly people.

But ditto only suggest these two as they get there commissions from them

I’ll maybe share a few tips on what not to do. Don’t buy an expensive plan for the heck of it (maybe upto 50L/1cr is fine for proper peace of mind, not more than that). Also if you guys are relatively healthy, it’s fine to get plans with waiting periods because it’s very unlikely you’ll fall sick in the first 3-4 years + you save more money in the long run.

Dont buy a topup - buy a fresh base plan always. Especially if depend on your employer provided plan too. If you lose/leave your job you lose those benefits, so always buy a fresh plan and don’t depend on topups and don’t depend on your employer.

If y’all rich then no need for insurance fyi lol. Upper/Lower middle class then please do. Will save your butt multiple times in the future.

50L/1cr is not possible IMO for senior citizen parents. It would get too expensive. Are you referring to life insurance?