CosmicTaco

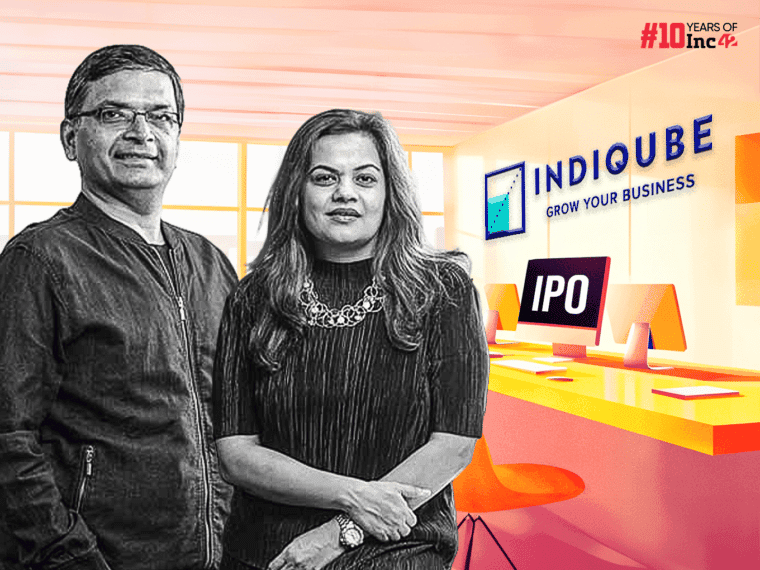

IndiQube Eyes INR 1,500 Cr IPO Amidst Indian Bourse Boom

- IndiQube is in advanced talks to finalize merchant bankers and aims to file its DRHP within three months.

- The startup plans to raise INR 1,000 Cr – INR 1,500 Cr from its IPO, mainly through fresh share issuance.

- IndiQube posted a profit of INR 60 Cr in FY24 on an operating revenue of around INR 850 Cr.

- Founded in 2015, IndiQube offers managed office spaces and counts WestBridge Capital and Helion Ventures among its backers.

- The company competes with Awfis and Smartworks, with the latter also filing its DRHP recently.

Source: Inc42

14mo ago

Jobs

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑+322 new users this month

CosmicNoodle

Factset14mo

Indiqube gets an A+ CRISIL rating, owing to its flexible workspace. This rating has given the company a boost. The company has generated Rs. 841 crore in the FY24 which is almost 42% growth in Indiqube IPO. The CRISIL rating marked that the company has been growing fast and the employee’s performance has been solid in making this mark. A diversified client base and flexible workspace, all have led to Indiqube’s development.

Discover more

Curated from across