Home loan Advise

I have home loan if 75L and I m getting salary hardly 1.4LPA. More than half of my salary goes to home loan. I would like to clear it ASAP. Give me advise on this

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Take another 75L and leave the country. New country new beginning

😑

Which bank will 75L for free. Loan will be on property. You can't sell it off or take with you n run. What's your strategy to get 75L n fly?

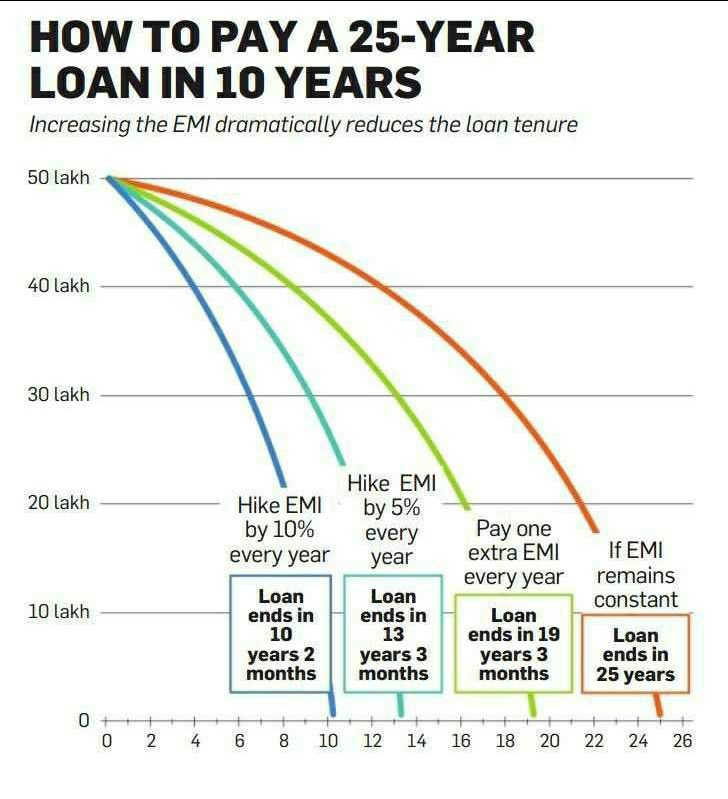

I had a 65L home loan, we increased EMI by 10% every year, paid extra EMI each year.

Started in 2022, right now - from 300 EMIs, it is down to 128.

Depends on your finances and whatever your pocket allows you.

I did the same and suggested here as well

How much extra EMI you paid every year?

Do as per your job security.

Consider converting your normal home loan to an OVERDRAFT home loan. This can be a lifesaver for you. Although the interest rate is slightly higher, the advantages are worth it.

I had taken a home loan of 40L for 20 years with 35k EMI. I kept dumping all my salary to this Overdraft account. Interest part was drastically reduced. I achieved the balance of 40L in 4 years. After that my EMI became zero. Also you can withdraw the surplus amount anytime during emergency. Interest will be calculated only on withdrawn amount. I explained advantages to my friends and they too changed to OD Home Loan. Usually Banks don't prefer giving these OD loans as its a loss for them. They will push you to take standard home loan only

Thanks for suggestion. I will try

Set your years at 20 and collect the extra anount and prepay every quarter

I wouldn’t advise you to increase your EMI as you are stuck with the payment schedule. Instead whatever amount or % you were thinking to increase it by, pay it manually.

This way the entire amount reduces your principle plus it gives you a flexibility in some months when you have additional expense.

If you really want peace of mind by closing it early; then put a big chunk of bonus into the payment annually. BUT MAKE SURE YOU HAVE YOUR EMERGENCY FUND CREATED. And it should be minimum of 12 months - including your EMI & monthly expense.

Just my personal take

Just to add, I had an initial EMI of 180 months, now we have got it down to 85 months in the span of 3 years

Never increase your EMIs or anything. It's so stupid if you are thinking long term. Consider this, u have taken a loan at 9%, even if u r able to make 9% on that money by investing you'll still be in +ve bcoz maths 101.

For peace of mind you can prepay, but get the balls.

How much EMI are you paying ? With 75 L loan I assume it's about 65k-70k per month? From 1.4 L monthly take home (again I assume it's take home and not gross), it leaves you about 70k-75k for monthly expenses and savings. I'll suggest a few things, nothing out of the ordinary.

- Without cutting down on discretionary expenses (travel, restaurants etc), put any extra income into prepayment. E.g. Qtrly or annual bonus you may receive.

- Your income will surely increase over the years, but unless you increase your emi accordingly, loan tenure will remain the same, which means more interest payment. So increase your emi in proportion to the hike you get. With job switch, do it even more aggressively.

- Check if you can get some money from your parents which you can use for prepayment. Then you can pay your parents back a monthly amount but without interest. It will not reduce your emi but it will surely reduce the tenure.

Thank you I will try to follow!!

Yes EMi would be 75K