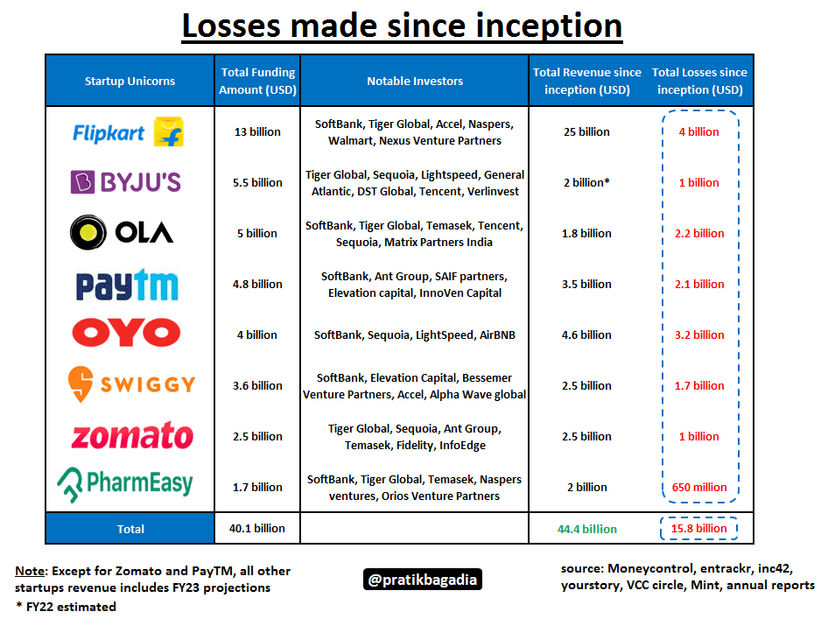

Flipkart losses widen by 42% to Rs 4,845.7 crore. Total loss of Flipkart since inception now amounts to Rs. 12,600 crore. And we are talking about the flag bearer of India's success story 's performance in 16th year since its inception

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

After 16 years of existence should we still call Flipkart a startup?

Even if people consider it a startup, it should be considered a failed startup since it recorded only 9% revenue growth in FY 24...

Either become profitable like public companies or show massive revenue growth like a startup.

Flipkart is worst of both worlds

"Profitable like public companies"

Zomato, Nayka, Paytm, PB etc laughing in the corner.

Even Amazon India isn't profitable on India operations even after 10 years of its launch - it's infact massively loss making.

I'm beginning to doubt large-scale ecommerce business model in India as a whole.

This is somewhat misleading.

Walmart isn’t looking for a profit, but to maintain the foothold in Indian market. That’s why they acquired Flipkart and are investing in it every year.

These headlines are just clickbait at this point. I don’t think they will lose a lot of a market share if they raise prices. It’s a trade off between reach and revenue, and they are still prioritizing each. With walmart money

But what's the point of incurring loss?

They will someday leave india like general motors, ford, fiat etc.

It’s an option value for them. Every public company wonders where there next big growth lever would come from. Keeping india as an option is something they can invest big in later once the usa growth becomes flat and Indian market has matured more. It may not work out that way, but at this point, it increases the investor confidence at Wall Street.

I don't think any of the online only e-commerce platforms are profitable, without playing around the numbers.

Bahar waalo ka paisa india mein duba rahe hain. Proud of them. Jai hind.

This is just for the B2B arm. Equally massive if not more losses expected in their B2C arm results too. On top of that Ekart, Myntra and other group companies losing money as well. Lord give all startups such shareholders as Walmart!

Does not matter its walmart subsidiary they will take care

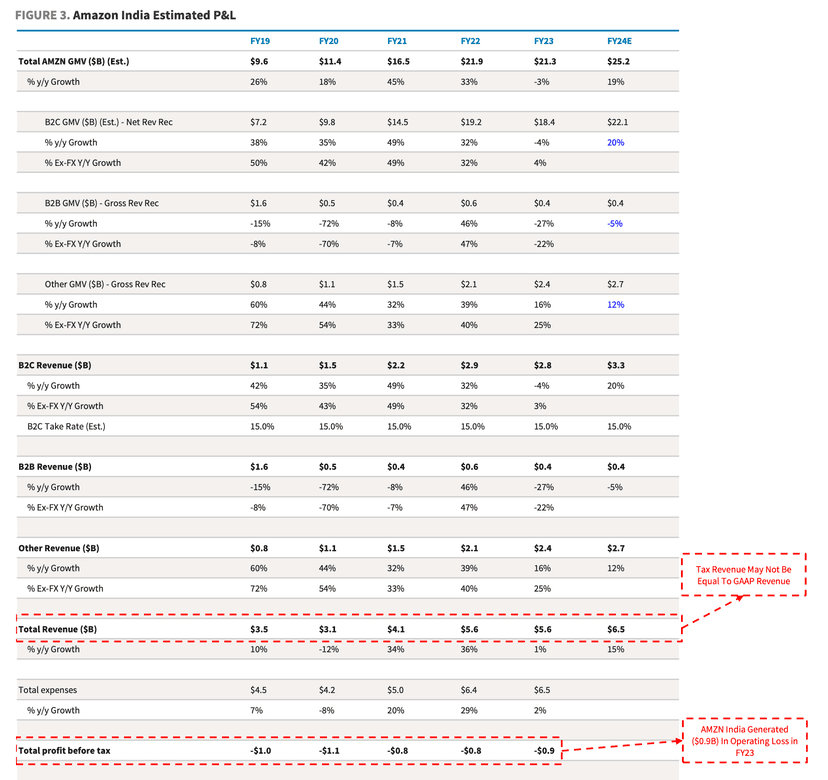

Amazon India's estd P&L: $21.3Bn in GMV, $5.6Bn in revenue (15% B2C take rate), $0.9Bn annual losses

- Overall, Indian eComm is now $120Bn in size

- Continues to be Amazon's fastest growing foreign market going into the closing of this year.

- FY23 was an impact of Covid baked in growth.

- Amazon would be quite okay with losing ju...