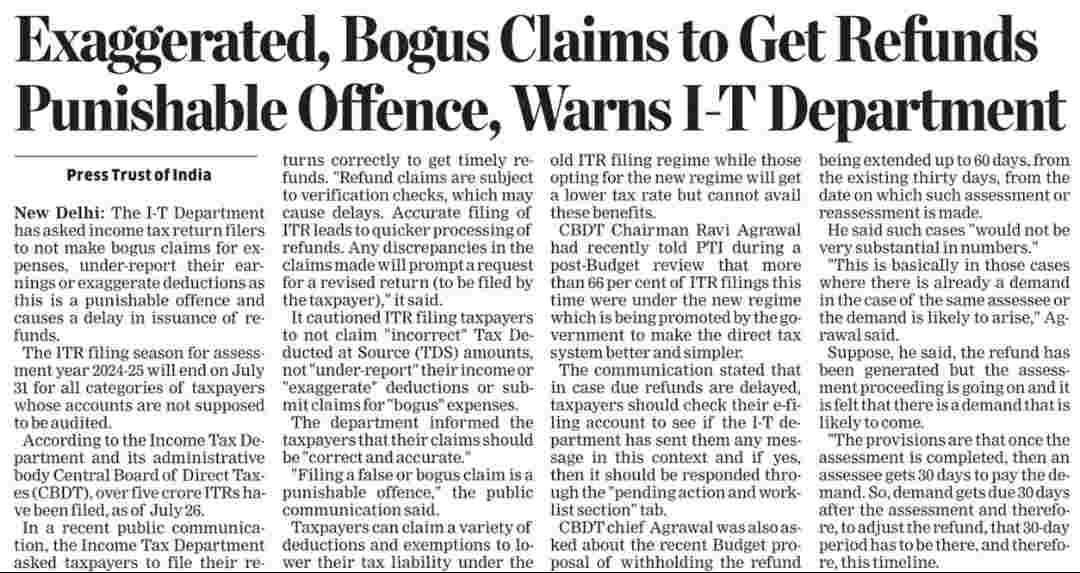

I see many of my colleagues consulting CAs for ITR filing and getting huge returns. What I gathered from their filings were bogus Health Insurance claims, fake HRA claims etc being utilised for showcasing huge deductions. These filings were done along with ITR 2 to somehow bring down the income.

Can anyone shed light on this practice? Are these legitimate CAs ? Is this not illegal? Don't they get caught ?

Note: This post is not to undermine CAs, but to understand how few CAs are doing this ? And is there really a way to decrease your taxable income, without having legitimate investments in the first place.