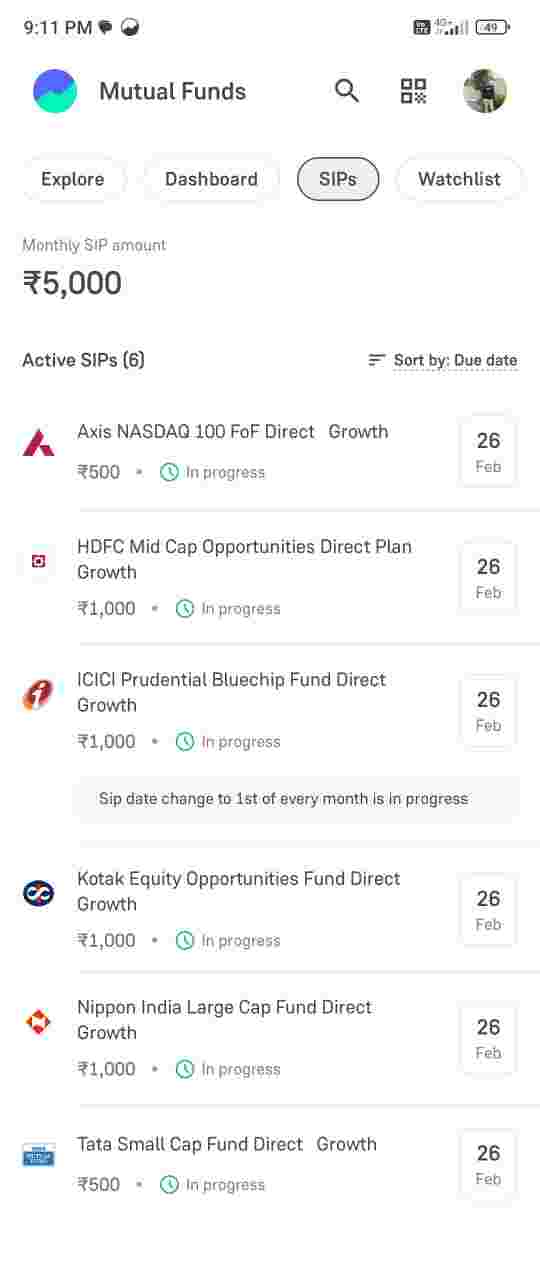

Best Direct Sips

One of my relatives wanted to invest in SiPs.

Asked my help coz am into direct stocks buying and USA market also. ( Made 10x in last 8y)

So, i checked his phone and got only Paytm and phonepe through which I could have subscribed sips.

But all of sudden I saw expenses like exit load and fund management 2% and 1% respectively.

So, i referred grow and alas! The same charge reduced to 0.XY % ( x and y = 0,1...9)

Then I researched little bit and got him these fund's.

5000 per month and 40% in large cap. ( Long term 15-20y plan)

He can have moderate risk.( Got 3 kids, planning for their 20s)

Please suggest if all these funds are fine or need to change something

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

I am new to the investing world and something is there in these modern day apps that my mind says don't invest via these apps. Instead signup into the separate fund managers website and then invest. Even though it is a hassle, I am leaning towards it.

Am I thinking wrong? Your comments?

Yes, you are thinking wrong. Whatever direct mutual funds you end up buying from these apps, they remain a property of you even if you switch apps from say paytm money to groww to kuvera. They are held with CDSL instead of being held by these apps.

There's no real downside of using them, and upside of having holistic view of your portfolio at one glance.

Yes I know that thing. It's just that I don't want to share my data with these new companies. Maybe I am thinking too much about it. Also app like groww create demate account without asking and now kuvera is with CRED means demate account will be necessary now😅

The fuck is about that dumb preamble in your post op

OP wanted social validation on his stock selection skills and financial knowledge

Seriously, I cringed out so hard reading the garbage op has written

I would've just kept parag parikh and nifty50. Consolidation is better in the long run.

Itna raita failane ki need nahi koi extra edge nahi milna. Each fund would have covered few sectors, itna sara overlap hoga at the nifty50 ka barabar return haat me aaega.

As you've traded individual stocks, should have noticed suppose out of 15-20 stocks held at a time half would perform more than nifty, few would be lagging, now if you hold 100 stocks even on the offshoot chance of few stocks being 2x-3x the net net in hand would be restricted due to smaller allocation.

These two and the ICICI NASDAQ 100.

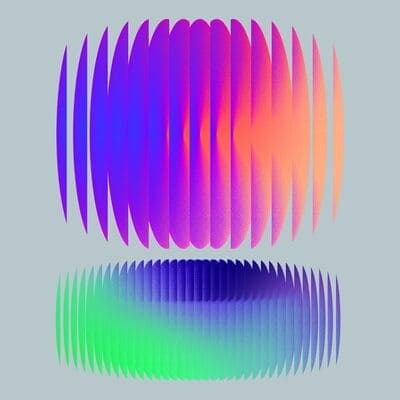

These are some of the good funds (aiming for high returns) to start in 2024. I created this list by referring to multiple good YouTubers who are well-versed in finance.

Large cap & Mid cap:

- Motilal Oswal

- Canara Robeco Emerging Equity

- Kotak Equity opportunities

- Mirae asset emerging bluechip

Mid cap

- Nippon Growth fund

- Multi cap

- Nippon multi-cap fund

Small cap

- Quant Small cap fund

- Axis Small cap

- Motilal Nifty Microcap 250 - Very high risk

Multi-cap / Flexi-cap

- Quant Active Fund

- Paragh parikh flexi cap fund

ELSS

- Quant Tax Plan

- SBI Long term equity fund

- Parag Parikh Tax saver fund

Thanks a ton dear

Check the overlap between these funds. If time horizon> 10 years, stick to mid and small caps only.

Add Parag Praikh

You might want to consider MFs by Quant. Have one of the best returns in the last 5 years overall and can invest in multi asset MF to reduce risk.

I want to invest in a MF where it invests in international stocks. Any recommendations on this ?

Already mentioned in pic attached above