Amex Gold: A No-BS rewarding credit card

Amidst the complex offerings of credit cards, Amex Gold is a breath of fresh air and is my 2nd most utilized card after Axis Atlas.

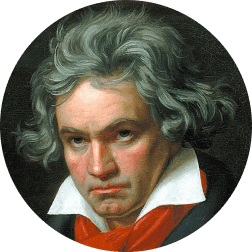

Mind you, I've not used this card extensively but rather for a very specific purpose every month. For those of you who are unfamiliar with it, the card offers 1000 bonus MR (Membership Reward) points upon completing 6 transactions of Rs. 1000 each within a calendar month.

How I have utilized the card is quite straightforward -

You earn 2 MR points for every Rs. 100 spent.

If you're buying a GV (gift voucher) through Amex GYFTR website with the Amex Gold, you get 5x the value, meaning10 MR points per Rs. 100 spent.

Buying 6 Amazon vouchers worth Rs. 1k each month to get (6*100 + 1000) = 1.6k MR points on a spending of Rs. 6k

Keeping the value of a MR point ~ Rs. 0.5, you get 13.3% as return reward which inarguably is a steal in the current credit card landscape

Repeating the same for 12 months, you get 19.2k MR points on a spend of Rs. 72k.

What can you get with 19200 MR points?

-

6k Amazon GV + 1.2k MR points still left

-

7k Shoppers Stop GV + 1.2k MR points still left

-

9k Taj GV + 1.2k MR points still left

-

19.2k Marriot Bonvoy points

-

6.4k Club Vistara points

-

9.6k Virgin Atlantic points

These are just a few of the many redemption options available. I've listed out the ones which I frequently redeem for.

The underrated advantage which I've always felt with Amex is their backend and customer support system. You typically receive your bonus points smoothly within a day or two after fulfilling the offer. Even if you don't, there is the ever so reliable live chat support ready to assist with inquiries.

As the title suggests, this card is ideal for people who prefer not to delve into the complexities of maximizing card benefits. It has got a very straightforward use to earn a very decent reward.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑How many points did you got to post this?

@SebastianVettel when are you coming back for your 5th WDC?

Noida mein race lagwao. Aaya main Hockenheim se, danke!

brb texting yogi ji

Hmm but I feel I am liking cashback much better than point system. Point rules can have changes anytime and also their expiry.

Amex Gold doesn't shine much if you're just looking for cashback. It glows the most when you look at the rewards in terms of travel and hotel stays or to a stretch, Gift vouchers too

Ya for those who travel a lot and stay in those expensive hotels it makes sense 💯

I’m starting my first job in June, pls suggest me good credit cards, how do I start and also tell it to pay rent via credit card or not

Hi, congratulations on your first job! First you need to answer, what do you want to get from your card? If it's okay, would you like to talk over DM? It's not easy to suggest a card if you're starting out, so would need to know bit more about your preferences :)

Sure, thanks a lot

Dm for referral, 750rs amazon voucher for applying :)

Hahaha nice of you to chimp on my post :) DM guys for something better 👀

Amex is good if targeting hotels points, so far I've gathered over 80k marriott points on less than 10L rupees spent over the course of 2 years.

What is the annual charges for this card?

Joining fees is ₹1000+GST if you apply through the referral, and annual fees is ₹4500+GST. Based on my personal experience, I was able to renew my card at 50% off waiver by just talking to them once.

If annual fees is a concern, you can also look out for Amex MRCC card which doesn't have a joining fees